Larry Kudlow to Fed Board of Governors?

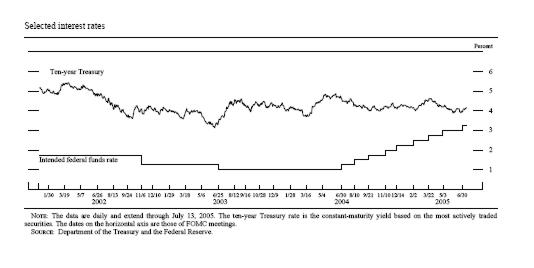

The credit crisis seems to have been instigated by the Fed’s raising of the federal funds target rate from a low of 1% over the entire year 2003 to 5 1/4% by mid-2006. This precipitous increase seriously upset apple carts and could well have sparked the wave of foreclosures in the subprime market. I recall Kudlow arguing during this period that the Fed was overreacting, that it had raised interest rates too far too fast, and it needed to drop them back down if it did not want to kill economic growth. But the Fed held onto this rate, even in the face of an inverted yield curve (long-term rates lower than short-term rates) all the way until September 2007. By this time, of course, the crisis was full-blown.

Federal Funds rate, 2002-2005

Federal Funds rate, 2005-early 2008

If Kudlow’s advice had been followed, the situation regarding the credit crisis, the weak dollar, and high oil prices might not be as bad as it is. And Kudlow has advocated a consistent policy, instead of being tossed by every wind of economic and political doctrine. Therefore, my vote (if I had one) would go to him to be appointed to the Fed Board of Governors.

That being said, there is one weakness in his strong-dollar advocacy. Not that there’s anything wrong with it, but it gives the impression that if the dollar were strong these other problems would not be such problems. But here in Europe, from where I am posting, similar problems are being faced. Not a credit crisis per se — only those banks that got involved in buying up US mortgage-backed securities are having a problem there — but an inflation crisis and high energy prices crisis. Gasoline prices have gone up in the same proportion as they have in the US, despite the fact that in terms of euros, oil prices have not gone up as much. (What’s up with that?) And inflation is becoming a stubborn problem, despite the fact that here the European Central Bank has stuck to higher interest rates (currently 4%). So there seem to be structural pressures at work beyond the level of individual monetary policy. That is the subject for another post, perhaps by someone with more insight than I can muster. But at the least it is food for thought.